Contents:

There’s also no https://forex-reviews.org/ account balance or inactivity fees for individuals. From stocks and options to even crypto, forex, and futures, there are many different platforms that you can invest and trade with in Canada. This page will compare the 15 best trading platforms in Canada for stock trading, day trading, options, CFDs, crypto, and forex. If you want to trade online, it is vital to avoid scams by only trading via regulated brokers, with a long track record, impressive reputation, industry awards and high client satisfaction.

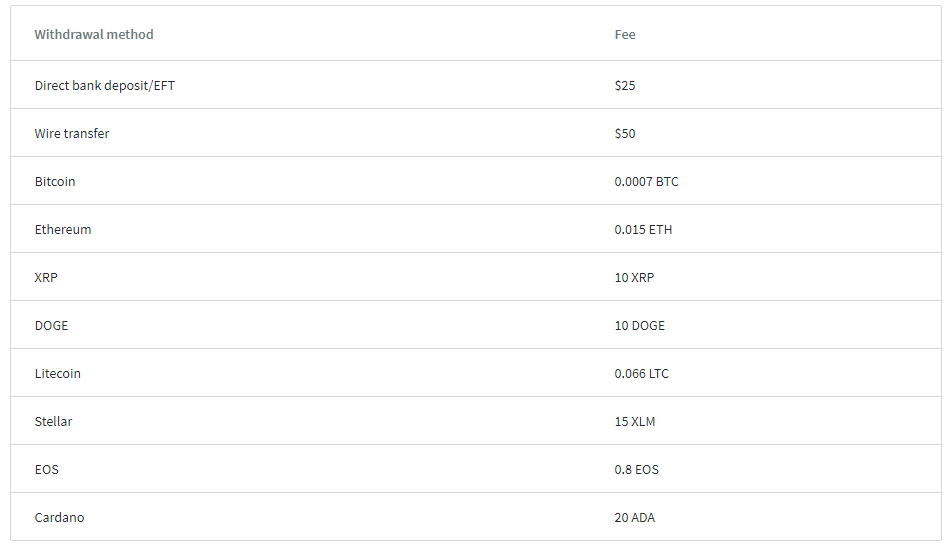

The relationship between Friedberg Direct and FXCM was formed with the purpose to allow Canadian Residents access to FXCM’s suite of products. You can fund your account with a credit card, debit card, or by wire transfer. There are no deposit fees, however, some credit cards may charge a cash advance fee. Withdrawals can be made back to the same credit card or debit card, or as a wire transfer to your bank account. National Bank’s InvestCube is similar to a robo-advisor that automatically rebalances your portfolio into various ETFs.

Investment Trends: Current Industry Performance And Award Honorees

Promises of unlimited profits – Scammers will claim things like, “churn out endless profits from the markets round the clock” or “guaranteed profits”. This is simply not true and even the best and most reputable solutions cannot ensure 100% accuracy or even close to that. Since 1999, FXCM has been on the leading-edge of the forex market. From technological proficiency to the creation of common sense solutions, FXCM has garnered many acknowledgements and accolades while promoting the advancement of the forex and CFD.

- For example, U.S. stocks have an overnight interest rate of 0.0189% for buy positions and 0.0144% for sell positions.

- Multiple levels of liquidity are visible at each price, providing extremely useful information to short-term and high-frequency traders.

- This page will compare the 15 best trading platforms in Canada for stock trading, day trading, options, CFDs, crypto, and forex.

- FXCM is also stepping up in providing educational resources and research for the market traders.

- FXCM wavered its Mini Account offering and reduced its CFDs to 32.

- Since then, FXCM operated with a clean slate and offered the public safe and reliable forex services aimed at harnessing the best interests of its traders.

Assignment and automatic exercise of options come with a flat commission of $28.95. While Interactive Brokers isn’t a commission-free broker, you can trade Canadian stocks for as little as $0.008 per share with a minimum commission of $1 per order. U.S. stocks have a commission of $0.0035 per share, with a minimum of $0.35 commission per order, up to 1% of the total trade value. Volume discounts can reduce your commission to as low as $0.0005 per share! That’s a fraction of the commission that the big banks charge in Canada for stock trades, which can be a minimum of $9.95 per trade. FXCM take care of the “little” traders as well as the Professional.

FXCM bonus

Unlike its offered Standard account, the Active Trader account charges its users a commission per trade along with a reduced spread. Regulators also check that brokers are not making unfounded claims or using dubious marketing tactics. Furthermore, in the case of a conflict, investors have a level of recourse with a third-party body whose express obligation is to protect investors. Beyond regulation, investors should also check reviews from trustworthy sites online where they can read about experiences of other real traders. Many review sites also thoroughly investigate complaints, as well as safety and security issues, such as KYC policies and website encryption standards.

FXCM changes company name; appoints interim CEO – Reuters

FXCM changes company name; appoints interim CEO.

Posted: Tue, 21 Feb 2017 08:00:00 GMT [source]

Since December 2003, Investment Trends has operated as a privately owned financial research company. Investment Trends provides industry-specific independent research data to members of the financial community. Currently, Investment Trends services companies in Australia, Singapore, Hong Kong, France, Germany, USA and the U.K. Supplement your trading strategy with free access to high-end institutional derived FX data through an eFXplus premium subscription.

Best Forex Trading Platforms In Canada ( : Trade Foreign Currencies

This can be waived if you set up a pre-authorized contribution of at least $300 per quarter. There are 100 ETFs that can be traded commission-free, and this includes many iShares, Vanguard, Horizons, and Desjardins ETFs. In order to qualify for commission-free ETF trades, you’ll need to hold the eligible ETF for at least one business day. The trading system is very easy to navigate around, and is simple enough for beginners.

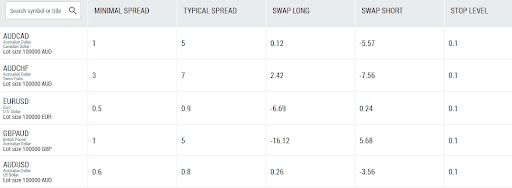

Forex.com charges spreads as low as 0.8 pips and does not charge trading commissions. While this is good in theory, the lack of flat or variable trading commissions translates into higher spreads when trading. Given the impact these fees have on your investment profits, it is important to research which online brokerage is suitable for your needs.

UK Forex Awards 2015 BEST FOREX TRADING AUTOMATION

A class action is a lawsuit that is brought by one or more persons on behalf of a larger group of people whose claims share common legal and/or factual issues. Class actions provide a cost-effective way for groups of people with common interests to pursue a legal claim. The Ontario and Quebec Courts approved a method for disseminating the settlement funds achieved pursuant to previous settlements (the “Distribution Protocol”).

As a self directed fxcm canada review, the best trading platform for you will depend on your investment goals and strategy to reach those goals. Investing in the stock market has become easier as technology enables more access to brokerage platforms. With so many platforms, clients are paying more attention and critically evaluating the different options. The Ontario court also approved Class Counsels’ fee and disbursement request. Bonuses and promotions are quite common offerings by brokers, including legitimate ones.

A committed team of experienced professionals offer top-tier technical support to Active Trader accounts. Great technical analysis research tools, rivaling even bigger brokers out there. Really appreciate how they lay out the straightforward fee structure, and not leave the trader guessing what they need to pay.

InvestCube requires a $10,000 minimum balance, and charges an annual rebalancing fee of 0.3% to 0.5%. If you’re a student 25 years of age or older, you can get discounted stock and ETF trades of $5.95, all with no annual fees and no minimum balance requirement. CIBC charges an annual account fee of $100 if your account balance is $10,000 or less. For certain registered accounts , the annual account fee of $100 is charged if your account balance is $25,000 or less. No annual fee is charged for TFSAs or RESPs no matter your balance. The Scotiabank StartRight program, which is a special program for newcomers to Canada, offers 10 commission-free trades when they open a new Scotia iTRADE account with at least $1,000.

We use dedicated people and clever technology to safeguard our platform. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Award-Winning BrokerSince 1999, FXCM Group has been on the leading-edge of the forex market. It’s great to hear that you are enjoying FXCM, and if you ever want to share any further feedback, we’d love to hear you out.

This means that the prime rate will need to be at least 5.50% before you’ll earn any interest on your cash balance with Questrade. The relationship between Friedberg Direct and FXCM was formed with the purpose to allow Canadian residents access to FXCM’s suite of products, while maintaining their accounts with a regulated Canadian firm. All accounts are opened by and held with Friedberg Direct, a division of Friedberg Mercantile Group Ltd., a member of the Investment Industry Regulatory Organization of Canada . Friedberg customer accounts are protected by the Canadian Investor Protection Fund within specified limits. A brochure describing the nature and limits of coverage is available upon request or at

In a lot of cases, forex traders will be using leverage to try and magnify their gains . Using leverage requires traders to maintain a minimum margin in their accounts and can lead to losses that are greater than the entire value of the account. Keep in mind that forex trading is riskier than investing in stocks due to its speculative nature and the typical presence of leverage.